Let me start this article with a disclaimer—that I am not a financial expert and as such everything you are about to read is founded on my own personal financial experience or activities and things I’ve read over the years in relation to this subject.

If you require expert advice on anything from me, then it should be LAW and Blogging. I have some good financial knowledge developed from my many mistakes over time and research, but I am far from an expert in this field. I am equally on a journey to learning and obtaining the best financial solutions/skills that fit my life and to create many sources of passive income.

What Are Shares?

Shares are equity stock or interest in a firm or a company.

This presents the ownership of a fraction or some part of a company. This ownership of a part means you own a proportion of the company’s profits and assets equal to how much stock you own. Note that, the distinction between stocks and shares is blurry and you do not have to bother with it. Both words are used interchangeably to refer to securities that denote ownership in a public company.

Why Do Most People Own Or Buy Shares?

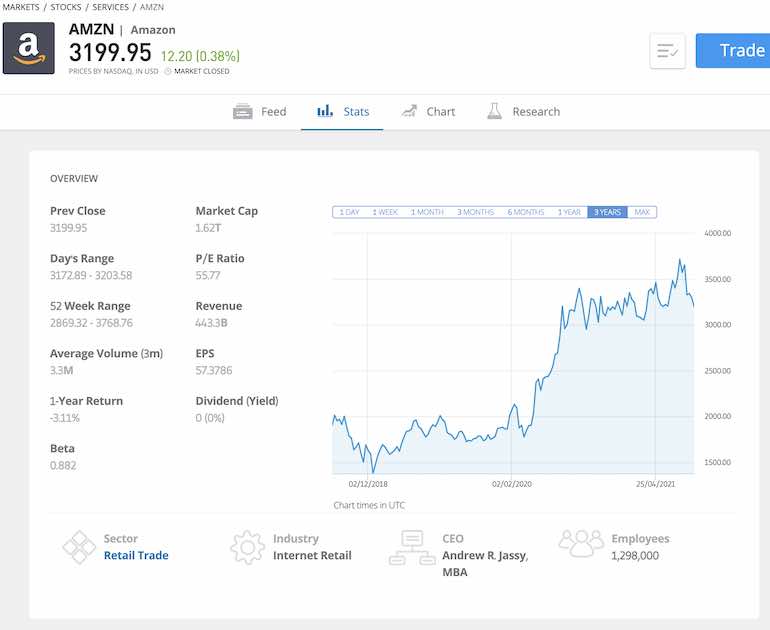

Let me answer this with a real-life scenario. On 16 December 2018, one (1) Amazon share was worth (trading) at $1,376.06. On the 4th of July 2021, the same one (1) Amazon share was worth (trading) at $3,714.17.

So if you bought just one (1) Amazon share on 16 December 2018 and sold it on 4th July 2021, you would have made a profit of about $2,338.11. If you had money and bought 10 Amazon shares on 16 December 2018 at the cost of $1,376.06 X 10, and sold them on 4th July 2021 at $2,338.11 x 10, you would have made a profit of $2,338.11 x 10 ( which is $23,381,11) in less than 3 years.

I do not know of any bank in the world that if you put $1,376.0 there, in less than 3 years, they will pay you almost 300%. But an Amazon share for the considered period paid that.

Many people buy shares (called investing) in order to acquire capital gains as demonstrated above—or in order to receive income from this investment in a form of dividend payments.

As a result of inflation, money loses its value over a period of time. Therefore, many smart people invest their monies to beat inflation instead of keeping their monies sitting in a savings account for a long term for inflation to erode the value of this money.

Risks Associated with Buying Shares

While the demonstration above shows that Amazon’s share price soared significantly over the stated time, it could have also fallen significantly over that time—depending on several factors including what was happening to the company and also the market.

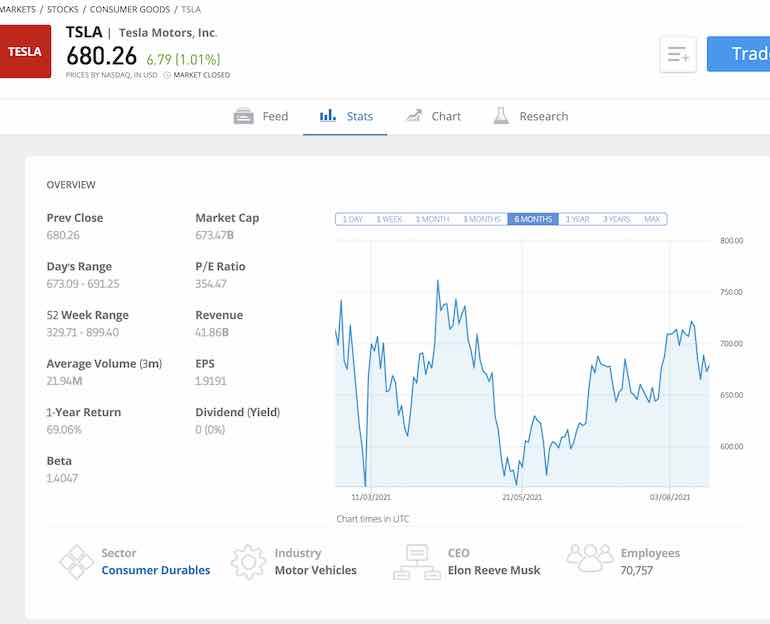

Let me illustrate this with another real-life scenario. On 13th April 2021, One (1) Tesla share was worth (trading) at about $761.60 and on 19 May 2021 (about a month later), the same One (1) Tesla share was worth (trading) at approximately $562.91—a fall of $198.69.

Of course, you have the option to hold on to a fallen share with the hope that it will rise again—as Tesla’s share has now risen to about £679.

The truth is, while you can gain significantly from directly buying shares of companies, you can also lose significantly depending on the companies you are buying into, the volatility of their shares, what becomes of the market, and many other factors including a pandemic taking over the world. Therefore, it is always good to know what you are doing—and I always tell people to start with companies that have low share volatility.

Buying shares in large public companies is considered is a medium-risk investment. And buying shares in smaller companies; companies with restricted or niche markets, often those which are developing new technology as well as buying shares in companies susceptible to international economic pressures are considered as high-risk investments.

You will have to always research and if possible speak to people who understand the market to guide you when it comes to directly buy shares in companies.

Currently, I hold shares in Delta Airlines and other companies. During the peak of the pandemic when travel restrictions were at their highest (and planes were grounded), the shares of almost all the Airlines fell drastically so I decided to take advantage of this and buy into this area.

As you can see from the chart above, the Delta Airlines’ shares I bought have increased by about 24% in about just a year. And has made me about 399 dollars’ profit.

How Long Should You Hold Your Shares for?

Some people will buy shares today and in a week’s time when it has increased, they will sell it. This will amount to short-term holdings or trading.

Others like me will buy and hold for years, and this is termed as long-term.

You can buy and hold shares for as long as you want. It all depends on you and whether you feel like it is right to sell at a time or to keep it. Some even hold on to shares until they die—and then the shares become part of their estate to be inherited by his family or chosen beneficiaries.

I bought 100 dollars’ worth of Tesla shares on 16 February 2021, today, it has fallen by about 14% and my 100 dollars is worth about 85 dollars—which means if I decide to sell today, I will get only 85 dollars even though I put in 100 dollars. Selling at this time will not be profitable for me so I will keep holding as I believe Tesla’s shares will rise with time.

Where/Platforms to Buy and Sell Shares

Many years ago, buying shares was tedious and the paperwork was painstaking. You need brokers and they would have had to buy the shares for you via some convoluted processes. Now, with the advent of technology, you can buy shares of many of the public traded companies from even your mobile phone. Buying and selling of shares have become less complicated and swift.

Personally, I use 3 main platforms to buy and sell shares and I will recommend these because they are easy to use. On these platforms, I own pockets of shares in Tesla, America Airlines, Delta Airlines, Amazon, Apple, Boeing, Coca-Cola, BT Group, IAG, and others.

Note that, there are several other platforms out there you can use to buy and sell shares online. However, your location (country) may determine access to these platforms including the ones I have listed.

If you are reading this article from a third-world country, you may have difficulty (or may not even be possible) signing up on these platforms or linking your bank account to them to enable you to buy and sell shares.

0 Comments